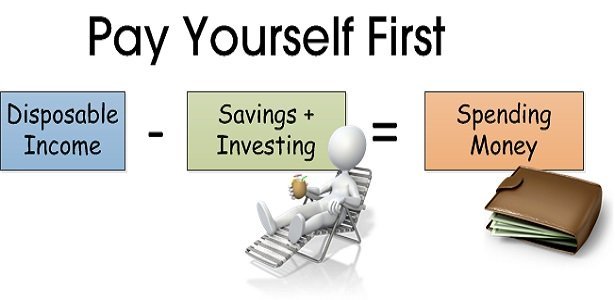

This is a fundamental law in personal finance, so fundamental that many people miss it and don’t take it seriously. Many believe that having an abundance mentality means spending on things you really want, even when you violate this law, putting yourself under avoidable financial pressure, and hoping that God will bail you out.

Another variation of this law is ‘live below your means’. I have an issue with this variation, as lack is implied and the picture you get is shrinking rather than expanding. I strongly believe in spending below your income and growing your means so that you have more money to spend to enjoy life more. That means at each point in time, don’t ‘eat with ten fingers’.

Much ado about the exchange rate

I am revisiting this topic due to the fact that a lot of people, especially the middle class seem to be having sleepless nights over the exchange rate of naira to the dollar or pound. The issue is so pervasive that someone was forced to ask ‘is the dollar your currency?’ How come we have become so fixated on the exchange rate? Are we manufacturers that need to import machinery or raw materials? A lot has been said about the foreign exchange policy – to devalue or not to devalue the naira. Whether the naira is devalued or not, we are making fewer dollars than we are spending hence your naira now buys fewer dollars than it used to until we shift the balance. What about the balance in your personal finances? Are you spending more than you earn no matter how noble the cause?

I read a brilliant piece a friend shared on Whatsapp lamenting how we have bastardized the naira due to our fixation with anything foreign, ranging from fabrics, food, football teams, cars, events, vacations, medical check-ups, you name it. It is hard to tell someone who can afford something not to do it. It has to be a conviction from within. The group of people I may have issues with are those who cannot afford it, and they seem to be in the majority. A lot of people think they can afford it based on their current income while in reality, they don’t because if they lose their jobs today, the music changes. Are they things you will stop doing if you lose your job today? If the answer is yes, you truly cannot afford that thing. That money may be better off working on your financial independence plan.

It is not in my place to say thou shall not do this or that. I am only asking a question – if you lose your job today or suffer a business downturn, can you still do that thing? Do you have control over when you lose your job? Sometimes you don’t. You can improve the odds in your favor if you are a high flyer, but no matter how high you fly, you get to retire someday and face the reality of life without your normal salary. If your oil price plummets, can you maintain your current lifestyle? If the answer is no, why begin to start with? Why go to the high table and be asked to come down rather than wait until you are invited up?

Some private universities in Nigeria are world-class. Some public ones are stepping up their game big time. I know of one that is working with top-flight US Universities on curriculum development and other areas of collaboration. There are world-class private hospitals in Nigeria and entertainment centers. Many sectors have gone world-class. Nigeria is now on the fashion, film, and music map of the world. A lot has changed since 1999. There is so much you can do in Nigeria. There is no point in spending money you don’t have on things that are not necessary to impress people who are not even looking.

Are you under financial pressure?

If you ever find yourself under financial pressure, you are attempting to spend above your income. The dollar is not our currency. We should not lose too much sleep over the antics of the exchange rate in the parallel market (which incidentally is about 5% of the forex market in Nigeria). There is nothing wrong with traveling abroad to do whatever you want to do if that is what you want to do and you can afford it. Affording it today also means you have the dollars. This means you also earn in dollars. The Central Bank has no issues with how you spend the dollars you made by yourself. There are no spending limits on dollar-denominated debit cards. It becomes an issue when you go shopping in naira and your bank via CBN has to pay your vendors in dollars using our depleting foreign reserves. The country cannot obviously afford it anymore.

If you could afford something before but the exchange rate has now put it out of your reach, you need to look for alternatives within your budget. Life is too short to live constantly under financial pressure. It is not good for your health, marriage (have you noticed that you quarrel more when you are broke?), your piece of mind and virtually everything (it is hard to focus on an exercise routine with financial worries on your mind). It is not a good place to be. You hardly enjoy life when you are under financial pressure. Payday even becomes a sad day because you know you are starting the month in a deficit.

You may not believe it, but you have a choice. Very few items on your budget are backed by the force of law – your children’s school, where you shop, live, ceremonies, you name it. They are all choices we make – choices that put us under avoidable pressure. Some people may be disappointed today if you take some decisions, but in five years’ time, nobody remembers because it was not important enough an issue. If you go through life trying not to upset people, you will be tip-toeing through life. That is not living, but existing. Give yourself a break. Declare victory and find your level. You have tried. Better days are still ahead. Sometimes you lose a battle to win the war. You will step up again and don’t have to come down again. It is simply a matter of time.

Photo: about.com