Your personal financial statement gives you a panoramic view of your cash flow scenario. In simple terms, you see at a glance, where your money is going.

Have you ever found yourself wondering where your money went? You are not alone. It happens all the time. The problem is, you are using your brain (RAM) to store your financial records, instead of paper or financial software (Hard Disk).

Our brains (like computer RAM) were never meant for information storage. It was meant for information processing. We clutter up our brains when we use them to store information. Paper and other information storage devices do a much better job, freeing up your brain to concentrate on thinking.

If you use your brain to store information, you will lose bits and pieces of it as time goes on, especially if you use it to store figures. That is the main reason why our sums don’t add up when we reconcile our finances after all the money is gone. We are left with the question, “Where did all the money go?”

That is why it is critical that we itemize our expenses online, in real-time, that is ASAP. If you leave it for later, you lose some information. This data is required to prepare your personal financial statement.

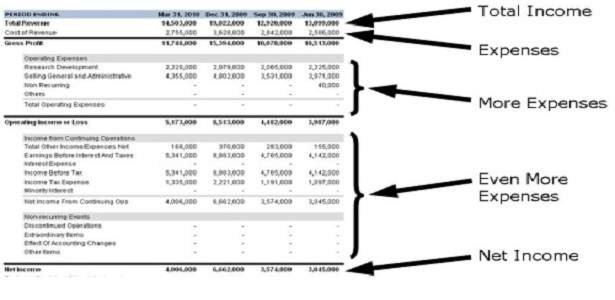

Your Personal Financial Statement

Your personal financial statement is not referring to the one you fill out for your mortgage lender or creditor. That is more general. This one is for your own consumption. Your personal financial reality TV show. It chronicles the whole show, uncut.

These figures tell the story of your financial life. You can see where you goofed, and where to make amends and apply the knife. Although you cannot see what you did with the money, you will be shocked to find out that the sums do add up. You can see at a glance, those nice things you can do without.

The forefront of the Hottest Battle

Keeping a record of your expenses is where the battle is won and lost. It is here most folks throw in the towel. Without these figures, preparing a realistic personal financial statement is difficult. Your personal financial statement is a crucial document and is needed to prepare other documents (Balance sheet and Financial Plan (Aka Financial Freedom Plan) etc).

To be able to budget effectively, you need to know how much you spend in a month. If you just put a figure on paper, you will be running a perpetual budget deficit, and a black hole will become a permanent feature of your budgets

Gathering this data requires a whole lot of discipline. I chose to call it “the forefront the hottest battle”. This is where most people give up the fight, and with it, their quest for financial freedom.

It may sound like an overstatement, however, control is the issue. Without these documents, you are clueless as to your financial state present past, and future. You cannot control what you do not know. You can make as much money as you want, but with power without control, you cannot achieve much.

You said it right in the last paragraph: "it is about control". I think that's the key to success. Combining this with another subject which you have written about, setting goals, and you have all you need for a successful financial life.

Congratulations for the post!

I quite agree with your submission, however, lam having problem subscribing to your rss